The XDAS Approach

To effectively tackle the challenges of monitoring misleading information and loan repayments, the XDAS team began by thoroughly analyzing the client’s specific needs and pain points. Understanding the complexities involved in managing data from over 5,000 educational institutions, we implemented a series of automated bots and workflows.

Data Integration

The process kicked off with seamless integration of XDAS into the client’s existing systems and third-party applications, establishing a continuous flow of data that laid the groundwork for real-time monitoring and analysis. XDAS deployed advanced Large Language Models (LLMs) to understand and process large volumes of text data to automate scanning educational institutions web pages. These models are trained to recognize patterns and language that may indicate misleading information, rapidly identify potentially misleading information, and minimize reliance on manual reviews.

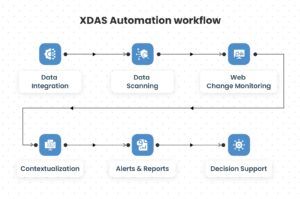

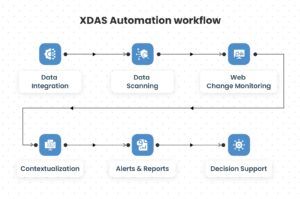

The workflow

The team introduced an innovative ‘Web Change Monitoring‘ workflow to enhance oversight. This workflow tracks targeted web pages for new content and updates, informing the organization about changes that could impact loan repayments. For instance, if an educational institution updates its loan terms or makes a misleading claim, XDAS will immediately flag this change, allowing the client to take swift action. XDAS contextualized misleading information through advanced reports as data flowed in, transforming raw data into actionable insights that empowered the client to grasp risks comprehensively and act quickly.

Visibility of potential issues

Moreover, when discrepancies were detected, XDAS triggered automated alerts to relevant teams in real-time, ensuring immediate visibility into potential issues and facilitating timely interventions to mitigate risks associated with loan repayments. This proactive approach allowed our client to address emerging challenges and safeguard their financial interests.

Insights for better loan processing

Ultimately, the holistic insights provided by the XDAS platform enabled data-driven decision-making, streamlined loan processing workflows, and equipped teams with the critical information necessary to improve repayment outcomes. These insights include a comprehensive view of the client’s loan portfolio, real-time risk alerts, and analysis of potential repayment issues.

Go beyond automation and turn unstructured data into action

Go beyond automation and turn unstructured data into action

Streamline data and turn ideas into workflows with a robust data automation suite

Streamline data and turn ideas into workflows with a robust data automation suite

Automation made simple through stories that matter

Automation made simple through stories that matter

Empowering innovation through purposeful partnerships.

Empowering innovation through purposeful partnerships.