-

Platform

Trending

Artificial Intelligence

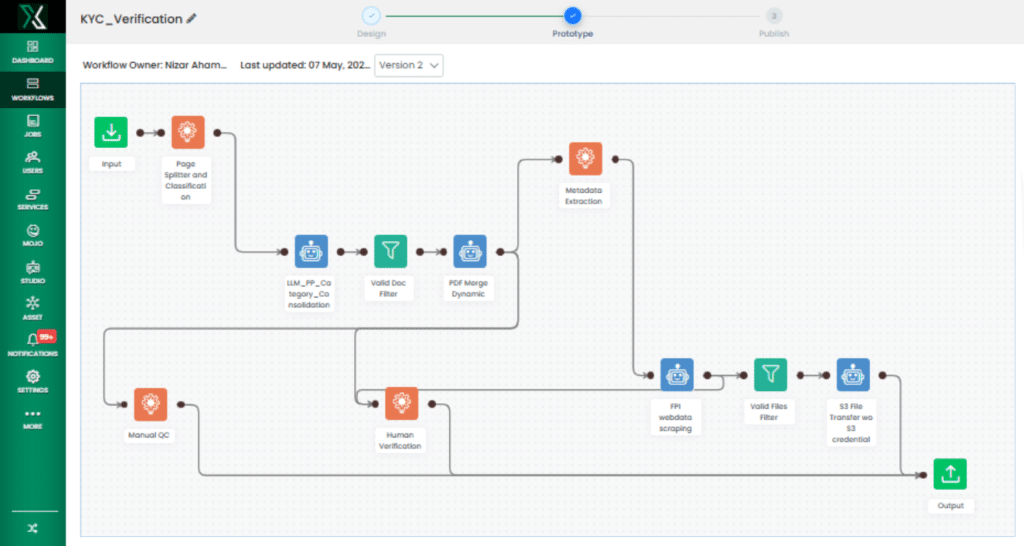

Advancing workflow automation with Human-in-the-Loop AI

Explore how adding a human touch to AI-driven automation improves accuracy, adaptability, and trust

Learn moreChoose XDAS Go beyond automation and turn unstructured data into action

Go beyond automation and turn unstructured data into action

- Solutions

BY INDUSTRY

WHAT'S NEW

POI Data

Industries Thriving on Footprint Data

Uncover the top 5 industries that depend on building footprint data to stay ahead.

Read nowsample heading

Artificial Intelligence

Grounding LLMs with RAG

Leverage retrieval augmented generation to tackle AI hallucinations and boost accuracy.

Read nowStart Watching Streamline data and turn ideas into workflows with a robust data automation suite

Streamline data and turn ideas into workflows with a robust data automation suite

- Products

Read more

Automation made simple through stories that matter

Automation made simple through stories that matter

- Resources

Collaborate now

Empowering innovation through purposeful partnerships.

Empowering innovation through purposeful partnerships.

- Case studies

- About

- Request a Demo