The XDAS Approach

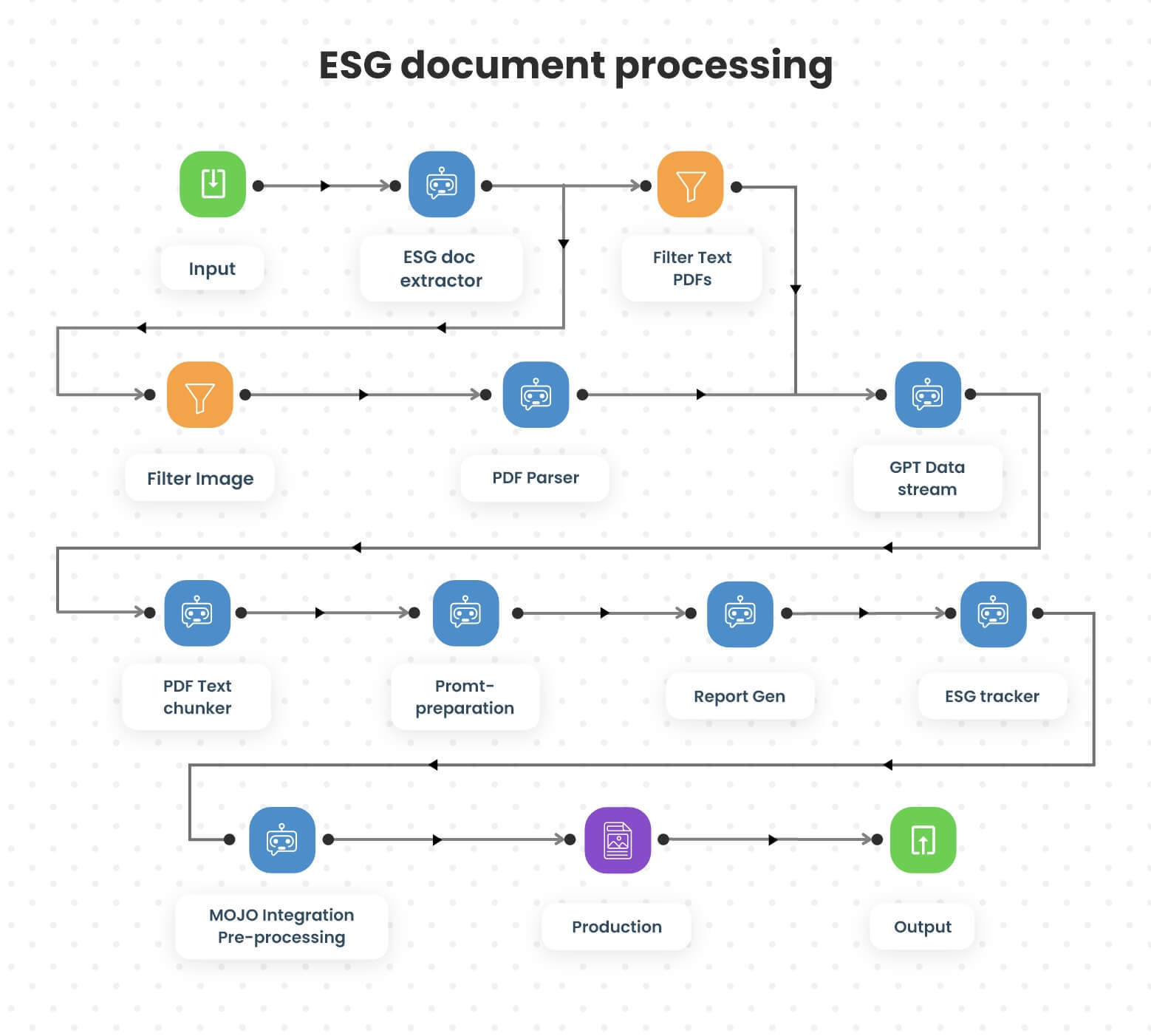

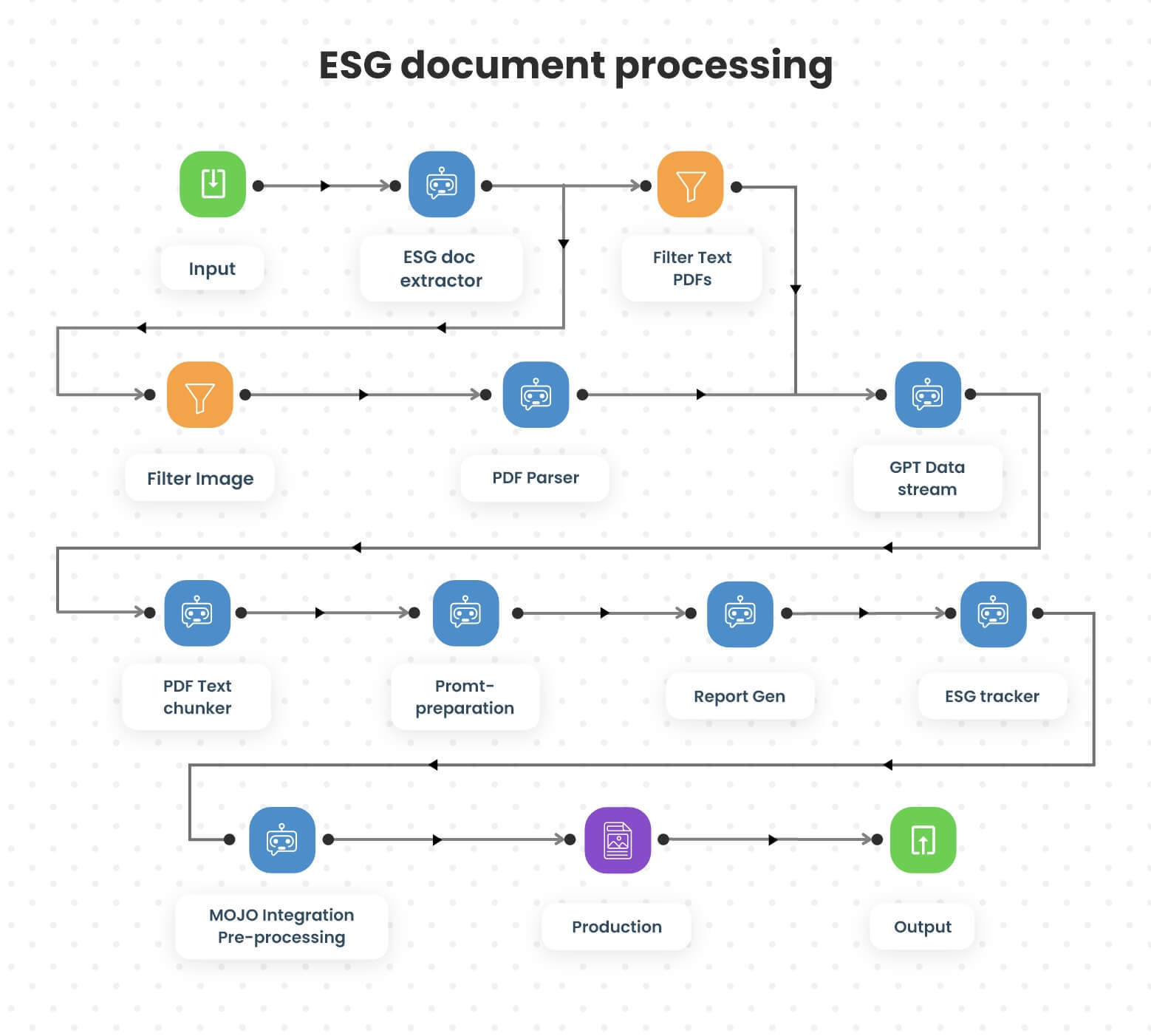

Catering to client’s ESG data needs, the XDAS team designed a comprehensive and structured workflow tailored to streamline ESG data processing, ensure accuracy, and ensure optimal regulatory compliance.

Seamless data extraction

To address the challenges, we first implemented the extractor bot, which captured data from text and image-based PDFs derived from diverse sources like BRSR, sustainability reports, CSR, IAR, CRISIL, and annual returns. We deployed a PDF Parser for image-based PDFs that converted them into text, enabling precise listing of over 1,500 ESG attributes.

Streamlined data processing

The workflow incorporated a GPT-enabled data stream to refine the extracted data, leveraging prompts to draw critical insights from the captured attributes. This process ensured that key ESG metrics were identified and organized for downstream processing. Lengthy reports were segmented into manageable chunks using a PDF Text Chunker for systematic and efficient data extraction.

Real-time regulatory tracking

The ESG Tracker kept the client informed by monitoring industry regulations and providing real-time updates on compliance requirements. This proactive feature ensured the client was aligned with fast-changing ESG standards and avoided regulatory pitfalls.

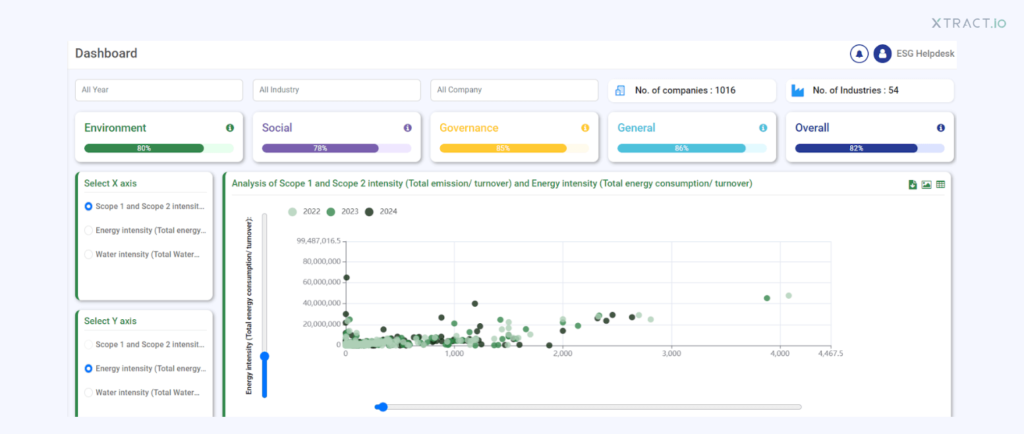

Multi-dimensional benchmarking

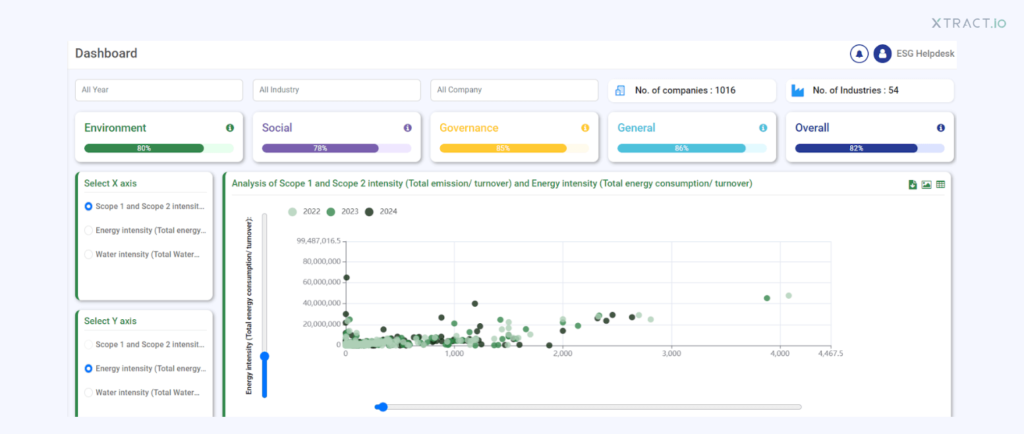

The XDAS platform enabled comprehensive performance analysis, offering insights into industry trends, peer comparisons, and portfolio performance. This way, clients can evaluate companies’ ESG practices at a granular level and compare and align performance with industry standards. This streamlined comparative analysis highlighted opportunities for improvement.

Human-in-the-Loop validation

The Human-in-the-Loop (HITL) mechanism was deployed through Mojo, where skilled human agents actively reviewed and validated the accuracy of the extracted data. These agents were crucial in resolving any missing or incorrect data within the auto-populated attributes in the automated data extraction process. This approach ensured that extracted data underwent rigorous quality control, mitigating risks due to errors and bolstering the reliability of the ESG reporting process.

Customizable reporting and dashboards

Integrating a report generator bot, the XDAS solution generated intuitive, customizable dashboards and downloadable reports in desirable data formats. This flexibility allowed stakeholders to acquire tailored outputs for their specific business requirements.

Go beyond automation and turn unstructured data into action

Go beyond automation and turn unstructured data into action

Streamline data and turn ideas into workflows with a robust data automation suite

Streamline data and turn ideas into workflows with a robust data automation suite

Automation made simple through stories that matter

Automation made simple through stories that matter

Empowering innovation through purposeful partnerships.

Empowering innovation through purposeful partnerships.